Comprehensive services

Get everything you need in one place to maximize your efficiency, save time, and focus on your business.

Work with us

reporting

and HR

client-centric approach with maximum flexibility

high expertise at local and international levels

comprehensive services: taxes, accounting, legal services

Tax

consulting

Slovak, European and international tax law consulting

Tax assessment of commercial contracts

Providing the VAT agenda , national and international legislation consulting

Consulting for transfer pricing , elaboration of documentation for transfer pricing

Mobility services , consulting for taxation and contribution obligations of posted employees

Representation in tax proceedings , participation in tax audits

Tax assessment of business combinations, acquisitions , support during portfolio sales and investments

Tax and Financial Due diligence

Benefits,

our customers get when working with us

More about benefitsFinancial accounting &

reporting

Continuous accounting and tax recording

Individual accounting consultations , which include consultations about non-standard accounting cases and accounting methodology

Preparation of annual , interim or extraordinary financial statements for the given accounting period

Managerial reporting

Transformation of the Slovak accounting standards to IFRS, compilation of IFRS reports for the purpose of consolidation of parent companies

Assistance during audits and preparation of documents

Benefits,

our customers get when working with us

More about benefitsPayroll accounting,

and HR

Comprehensive payroll processing , calculation of salaries, contribution fees, and salary deductions

Online archive of HR documents in the payroll portal

Payroll reporting according to the individual needs of management and controlling

Consulting concerning posted workers in terms of tax and contribution obligations

Processing of personnel agenda associated with the exit and entry of employees

Representation during tax investigation or investigation of the National Labor Inspectorate and other authorized institutions

Benefits,

our customers get when working with us

More about benefitsCorporate

services

Providing of the company's registered office address and related agenda, including mail processing

Providing expert’s opinion and expert activities to determine the value of the company's assets

Providing business meeting facilities

Financial statements audit in accordance with the Slovak law

Comprehensive administrative services

Legal advice concerning the local and international transactions and intentions

Translation and interpreting services

Benefits,

our customers get when working with us

More about benefitsBenefits,

our customers get when working with us

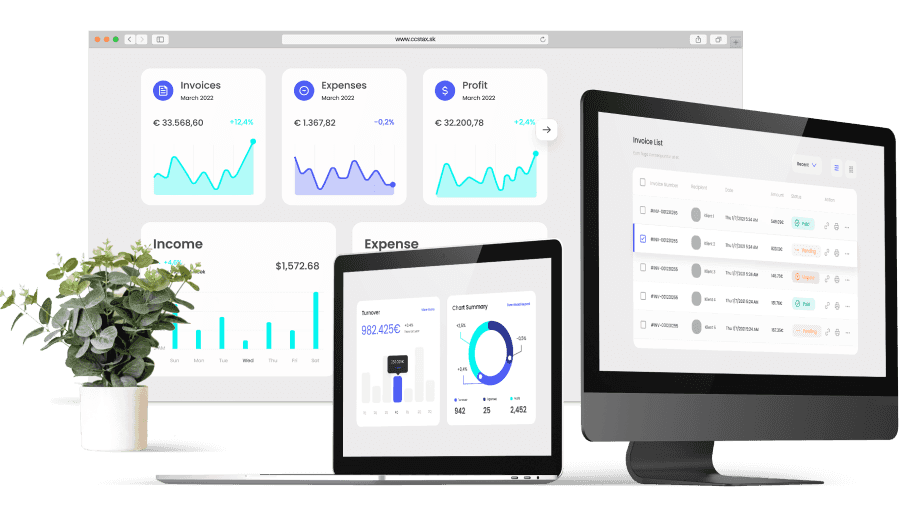

Helios and Human Software for businesses + maintenance

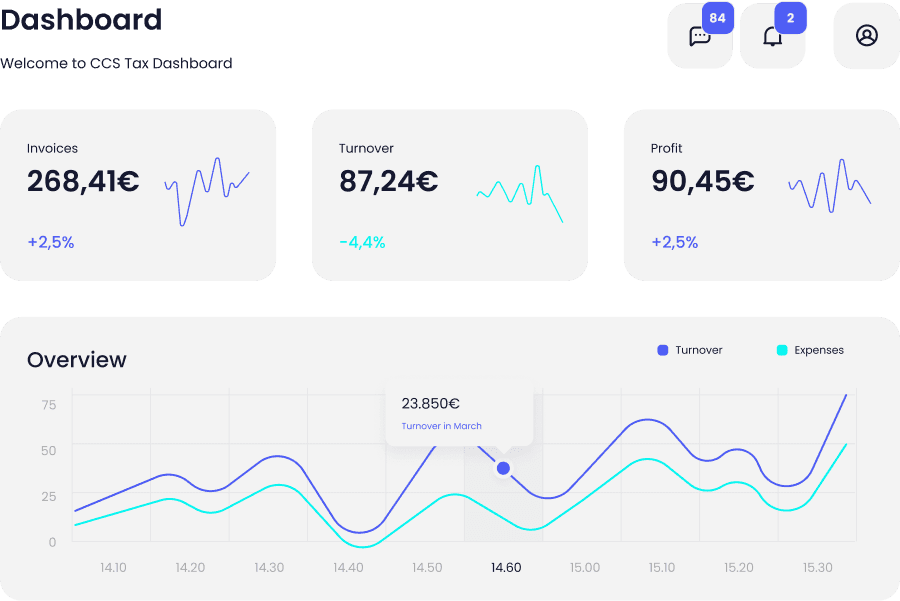

These systems streamline your business processes and provide a business overview.Digital reporting

You get all the necessary information about the financial status of your business. Just log in directly through our website.

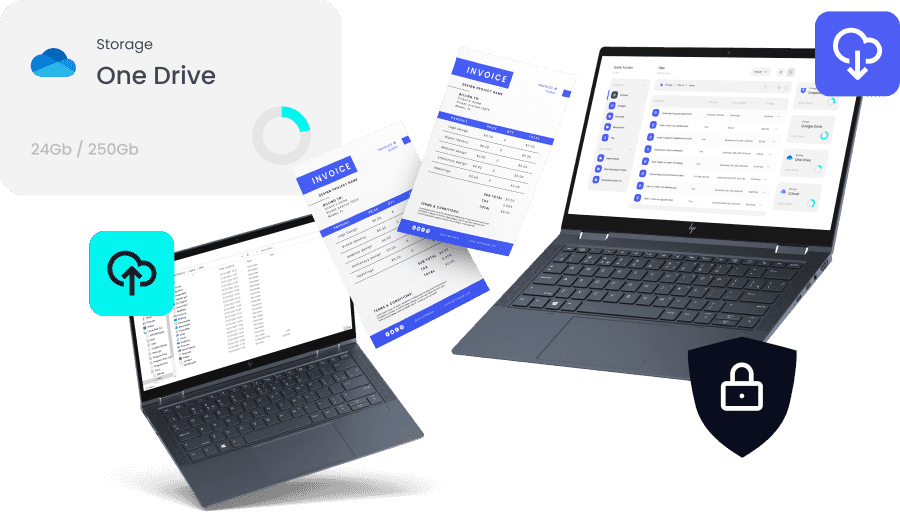

Data Room Cloud

We provide easy and secure document sharing in one place without wasting your time.Effective communication

Your partner should always there for you when you need them. We want to respond promptly to your requests that is why we use effective communication applications.

4 easy steps,

to have efficient business